BICA CALLS FOR THE WITHDRAWAL OF THE CONCEPT OF THE PERSONAL ACCOUNTS OF PHYSICAL AND LEGAL PERSONS

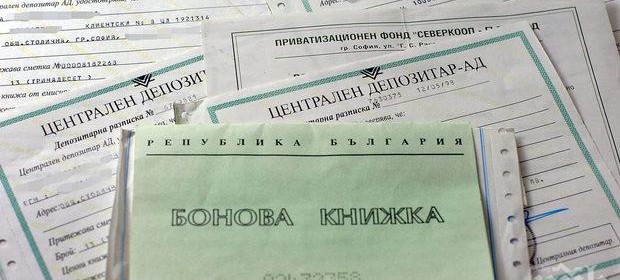

The Bulgarian Industrial Capital Association (BICA) insists on the withdrawal of the Concept of Personal Accounts of Individuals and Legal Entities held by Central Depository AD. The implementation of the concept will affect nearly 3 million Bulgarians – owners of shares acquired during the privatization. According to the employers’ organization, which is the main expression of the interests of the issuers, the concept proposed for public discussion is in striking contradiction both with the Constitution of the Republic of Bulgaria and the guaranteed property rights and with the Treaty on the Functioning of the European Union.

The prepared concept envisages the introduction of a mandatory transfer of the shares of Registry A to the Central Depository in Register B to investment intermediaries. Thus, each shareholder will be forced to transfer to investment intermediaries within a period of one year. If during this year the owner of the shares does not transfer them voluntarily, they will be transferred without his will to a specially created investment fund against shares in the fund. Upon the expiration of a new term and in the absence of action by the unit-holders, their shares will be nationalized and deposited into the Silver Fund.

Currently, the holders of shares do not pay fees to the Central Depository. Undertakings pay the Central Depository to maintain Register A. By transferring the shares to an investment intermediary these payments will be at the expense of the shareholders. In short – their shareholders are offered either by their free Registry and willingly to transfer their shares to an investment intermediary and to pay in the future all due fees and to lose their shares in this way in the long run, or to take nothing and to lose the shares in the short term.

There is no act of European or Bulgarian law, nor practice that would imply and even less to impose such an innovation as the proposed concept.

BICA recalls that the presented concept is not considered for the first time. A previous one has already been rejected by the predecessor of the Capital Markets Development Council, and a working group set up by the Ministry of Finance has not reached any outcome following objections by the Ministry of Justice, Bulgarian Industrial Capital Association, the Association of Bulgarian Investor Relations Directors.

According to the employers’ organization, the effect of the proposed seizure decision, based on the lack of interest of the owners of “dormant” shares, is not different from the confiscation of a bank deposit in which there is no movement, or of an unmanaged vehicle or of immovable property, which is not used.

BICA shares the understanding that there are problems with the inheritance of the shares, the management of the shares of the emigrated Bulgarians and of the Bulgarians who live in areas without any licensed investment intermediary. But not nationalization is the solution to these problems. With the proposed Concept for personal accounts of individuals and corporate entities kept by Central Depository AD in Registry A, no problem is solved. On the contrary, there will be new problems for nearly three million shareholders and hundreds of businesses, which will particularly negatively affect the investment climate and the image of Bulgaria around the world. According to BIC, if the authors of the concept really want active management of the “dormant” shares, it is far more meaningful to provide measures and opportunities for remote management of these small bundles of shares, reduce or even eliminate the management, transfer and mostly for inheritance. In view of the above, the only right solution is for the draft concept to be withdrawn by the importers.

English

English